Witham ahead of the game with new plastic tax

A new tax on plastic packaging (PPT) was introduced in the United Kingdom with effect from 1 April 2022.

Put simply, this is a tax on any material that is designed to hold or carry another item and is made of plastic and/or has a ‘significant portion’ of plastic. The aim of this tax is to incentivise and increase the use of recycled plastic against non-recycled plastic.

The implications of this tax will be felt across many businesses in any sectors that use plastic packaging. Particularly relevant for the food and drink industry, the new will mean that manufacturers and importers of plastic packaging will have to pay a minimum rate of tax based on the volume of plastic packaging they put onto the UK market.

Who is liable to pay PPT?

The UK is one of the largest exporters of plastic packaging in the world. There are currently over 5,000 businesses involved in the manufacture or importation of plastic packaging in the UK, including Witham Group. Businesses that produce or import more than 10 tonnes of plastic packaging per annum will be liable to register for the PPT scheme.

Any business that manufactures or imports plastic packaging in the UK will need to register for a PPT account. There will also be a credit system where companies can apply for credits on exported packaging including on packaged goods.

What products with be affected by PPT?

Plastic tax will be charged on plastic packaging that has less than 30% recycled content. The tax will be extended to imported products like drinks in plastic bottles. Products that include the heaviest component (plastic) will be considered plastic packaging and thus subject to the tax. Certain exemptions apply. For example, PPT will not be charged on medicines with a license for human consumption, or packaging used to secure the safe transit of goods in international trades. This means that PPT will not apply to packaging used solely within trade or transits.

How much is plastic packaging tax?

PPT will be set at a rate of £200 per metric tonne of plastic packaging (that contains less than 30% of recycled plastic).

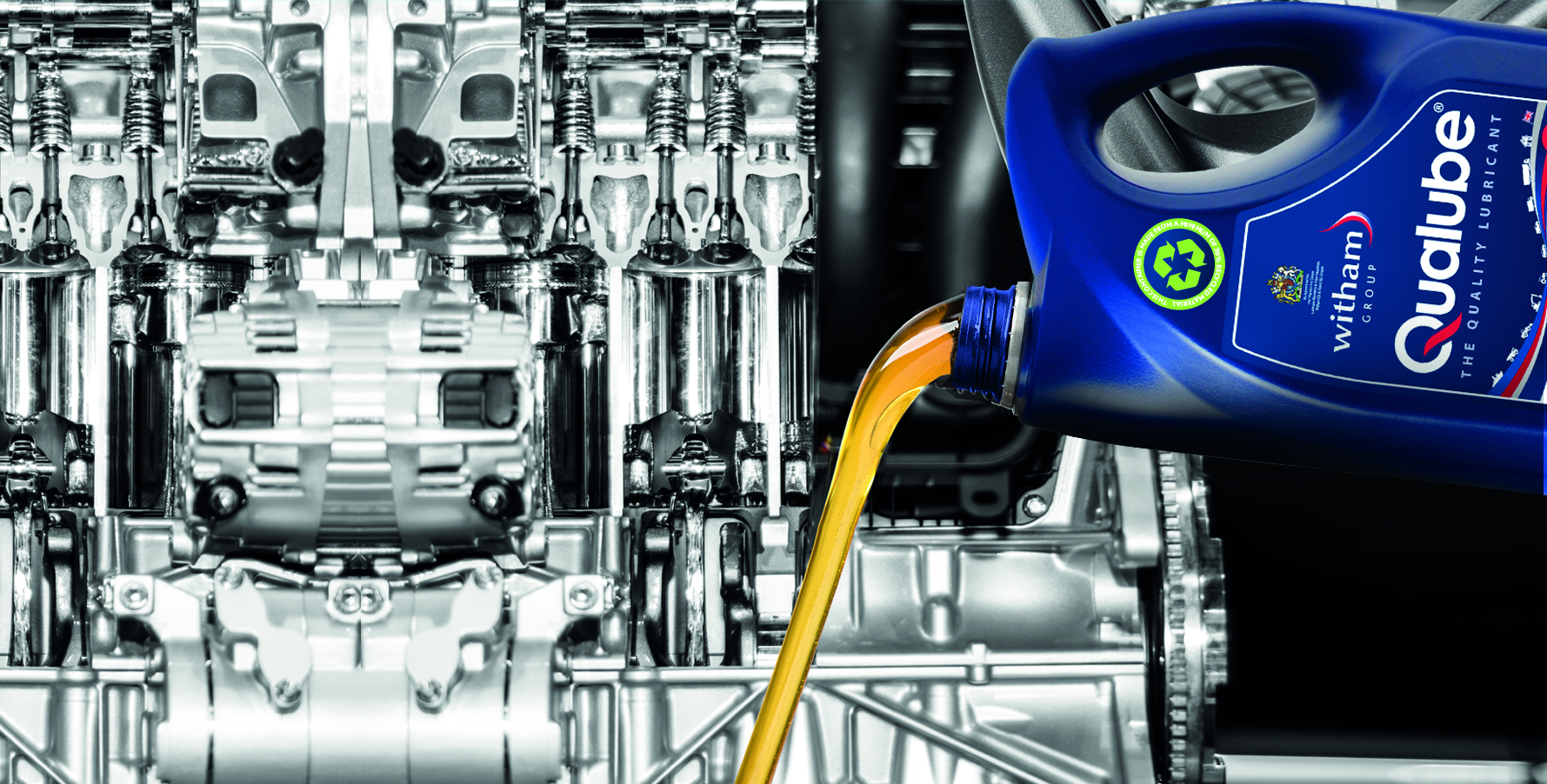

How we’re ahead of the game at Witham Group

Luckily for Witham Group, as part of our own drive to be more environmentally conscious, we switched to using plastic containers that have at least 30% recycled materials in them so we are exempt from this new tax. There will be many of our competitors however who will not be so ready for this new law and may have to passed further price increases for this onto their customers.

To read more about our commitment to the environment and the steps we’re taking to reduce our impact, visit our website here.

Leave a Reply